Taxing EU's agricultural commodity imports to incentivise tropical and subtropical forest restoration

Lars Holschuh

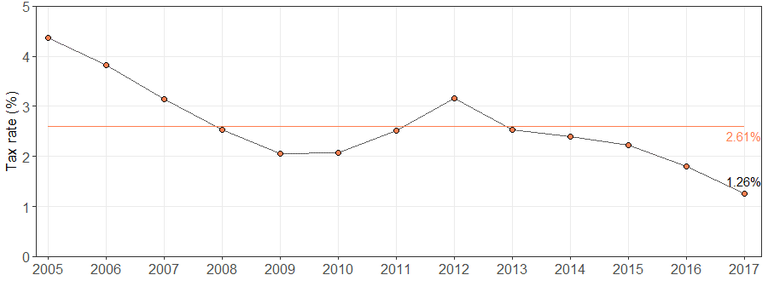

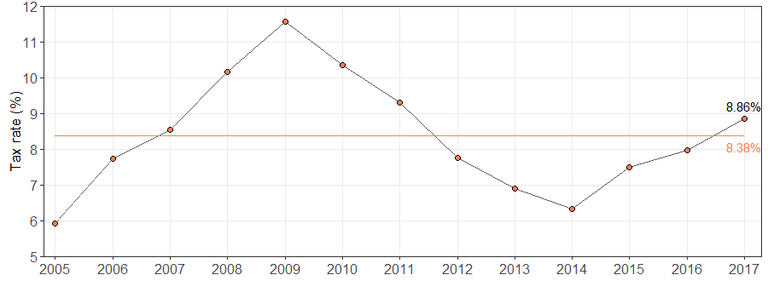

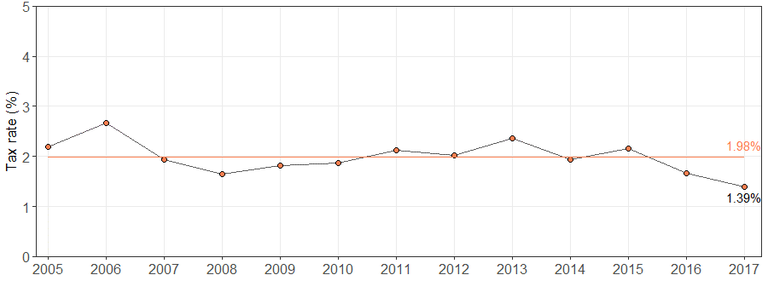

Tropical forests are global biodiversity hotspots and key carbon storages. Nevertheless, tropical forests disappear through deforestation driven by human activities. The EU’s imports of commodities like soybean, palm oil, beef, coffee, and cocoa are associated with tropical deforestation in the export countries, triggered by agricultural expansion. I designed a commodity tax that aims to decrease the EU’s consumer demand for those commodities. Demand is reduced and harvest area is released, which possibly avoids agricultural expansion into forests. I conducted a systematic literature review to identify own-price elasticities of demand for five commodities that account for 79.6% of the deforestation embodied in the EU’s imports between 2005 and 2017. Based on these demand elasticities, I explored which tax rate amounts for each year and commodity would have released sufficient harvest area to possibly avoid deforestation associated with the EU’s commodity imports between 2005 and 2017. As a last step, I explored to what extent the generated tax revenue could be used to fund forest restoration projects, supporting the achievement of the Bonn Challenge objectives. My results suggest that an average commodity tax between 4.72% and 2.87% would have released a harvest area matching the deforestation area embodied in EU imports of the five commodities between 2005 and 2017. More precisely, tax rates of 1.26% for soybean, 1.39% for cocoa, 2.27% for coffee, and 8.86% for palm oil would have released a harvest area as large as the deforestation area in 2017, thus possibly avoiding agricultural expansion into forests. Besides, by implementing these individual tax rates, a tax revenue of US$ 0.731 billion could have been generated in 2017. By financing forest restoration with the generated tax revenue and depending on the cost-efficiency of a restoration project, the EU could fund thousands to millions of hectares of forest restoration. Besides, by introducing a commodity tax, the EU could halt deforestation embodied in its imports which supports the achievement of the EU’s zero-deforestation pledge.

Fig. 1. Tax rates that release soybean harvest area matching its deforestation area (2005-2017). Here and further the horizontal line demonstrates the average of each commodity’s tax rates between 2005 and 2017. Both the tax rates for 2017 and the average tax rates are rounded.

Fig. 2. Tax rates that release palm oil harvest area matching its deforestation area (2005-2017).

Fig. 3. Tax rates that release cocoa harvest area matching its deforestation area (2005-2017).

Fig. 4. Tax rates that release coffee harvest area matching its deforestation area (2005-2017).